From Reseller to Brand Builder: Luke Peters’ $80M Success

A lot of companies are tempted to resell other people’s products and services as a quick path to hitting their next revenue milestone. While this approach might boost your top line, it often comes at the cost of your company’s long-term value. Acquirers aren't just looking for companies that generate revenue—they usually want businesses that bring something unique to the table, something they can't easily replicate.

Finding a Quiet Corner of the Market

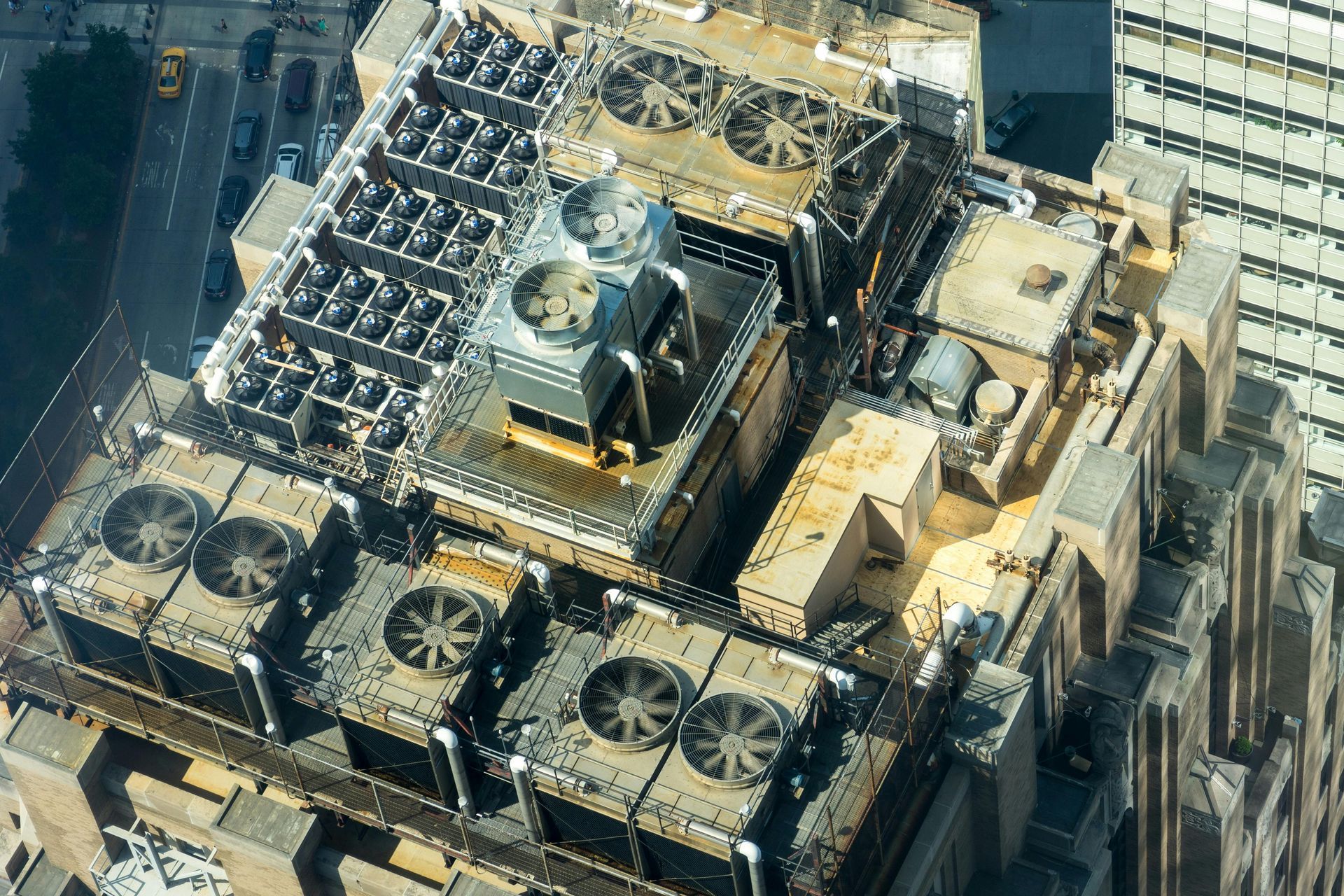

In the early days, Luke Peters sold portable air conditioners and thermostats online. When he made a sale, he’d head to a local industrial supply store, buy the unit, and ship it to his customer. He added no value and operated as a thinly veiled reseller with razor-thin margins.

But Luke began thinking more strategically about his business. Instead of competing in crowded categories like air conditioners, he found a quiet, underserved corner of the HVAC market: portable beer and wine fridges. That’s when he started to build his own brand, NewAir. By focusing on this niche, Luke didn’t have to battle the big players like Whirlpool in traditional appliance categories. Instead, he carved out a segment where NewAir could dominate and create a brand that stood out.

This strategic shift allowed him to build a brand that was recognized for delivering products that were easy to ship, fun to own, and specifically appealing to a target audience. By owning his niche, Luke unlocked a path to profitability and business value that wasn't dependent on thin reseller margins.

The Value of a Brand

In The Value Builder System™, product or brand differentiation is referred to as Monopoly Control—the ability to dominate a niche with an offering so unique that competitors can’t easily replicate it. Achieving Monopoly Control boosts your company’s value in three key ways:

1.Commanding Higher Prices

Differentiated products deliver unique value, making it easier to charge premium prices. Luke transitioned from reselling low-margin portable air conditioners to the relatively untapped market of premium bar and wine fridges. This shift raised his gross margin and net profitability—two of the most critical metrics in valuing a company.

2.Increasing Customer Loyalty

When customers see your product as distinct, they are less likely to switch to competitors. Luke’s products weren’t just functional; they delivered an experience, fostering emotional connections that encouraged repeat purchases and stabilized revenue.

3.Acquirers Pay a Premium for Differentiated Brands

When acquirers evaluate your company, they’re making a “build vs. buy” decision. They’re asking, “Should we buy this business or simply compete with it?” Acquirers pay top dollar when they conclude that replicating your point of differentiation would be too costly and time-consuming.

Lasko Acquires Luke’s $80 Million Business

By finding an underserved niche and building NewAir around it, Luke Peters grew the company into a business generating $80 million in annual revenue. His success culminated in NewAir being acquired by Lasko Products in 2021, marking a significant milestone in his journey from reseller to brand builder.

or

Recent articles for you